Today's administration of private investments involves thousands of emails, portal links, lost logins, dense documents, and manual data entry. We’ve done the math, and the average fund sends 19 high-value updates throughout the year requiring your attention. Arch allows you to manage all your private investments alongside stakes in private companies, in one platform, seamlessly.

Automatically collect all private investment documents.

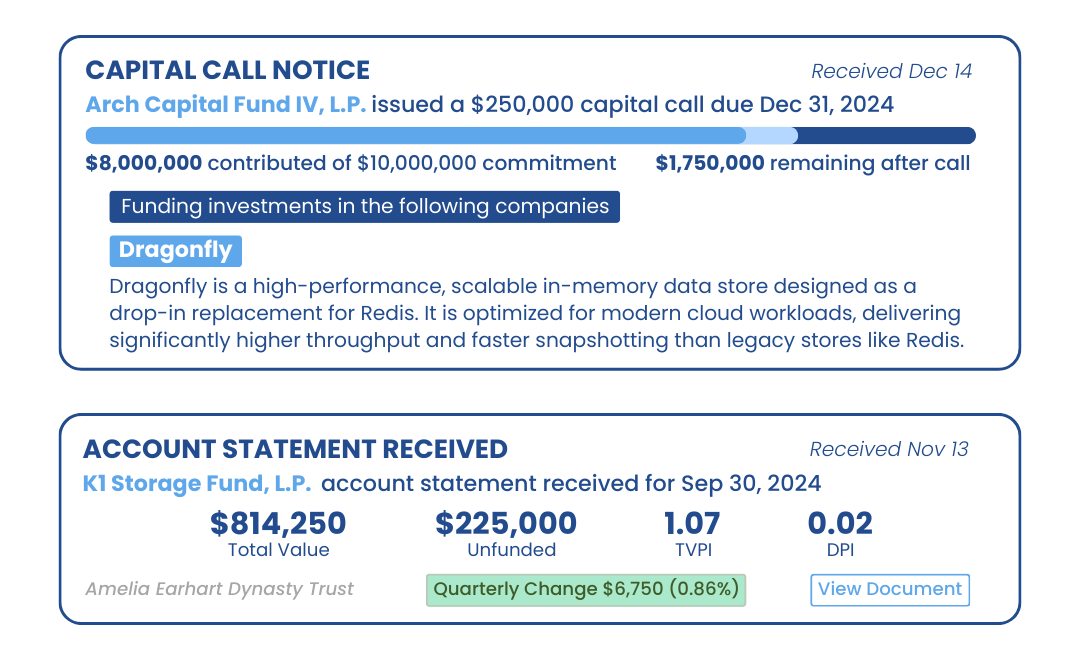

No update is too small: Arch collects and classifies all correspondence pertaining to alternative investments, while parsing relevant information from actionable documents like account statements and cash flows. Receive a standardized, high-level view of the entire portfolio across all managers with up-to-date valuations based on received reporting and cash flows.

Never log into a portal again.

Arch gets added as an interested party on each investment to collect, standardize, and centralize all communications, documents, and data across all institutions and managers. All in one place.

Coverage? Don’t worry about it.

Our model is simple — any and all updates received by an investor or advisor will be received by Arch on a go-forward basis. With tens of thousands of existing unique fund relationships, Arch’s scope of coverage is expanding daily, as new investments are onboarded, reviewed, and processed.

Automated document processing

Every communication received by Arch enters into a queue for processing by Arch’s proprietary systems, leveraging a combination of machine learning and generative A.I.. Any update that cannot be wholly processed by these automations is escalated to an expert NYC-based Operations team for validation and delivery. Additional layers of exception processing ensure data quality and accuracy across hundreds of thousands of investments.

Core Offerings

Arch manages all documents and communications, serving as the portal of portals.

Leverage next-generation technology for data extraction and workflow tools with automated exception processing. The Arch difference combines sophisticated automations backed by seasoned professionals optimizing each step. Post-onboarding, monitor investment activities via email with the Arch Daily Digest and stay on top of required actions with corresponding tasks.

Never miss a tax filing deadline again.

Arch provides automated tax collection, estimated delivery forecasting, and proactive outreach for documents deemed overdue. For Tax Year 2023, Arch received, validated, and delivered over 100,000 tax documents to clients.

Create custom team workflows.

Keep track of outstanding capital calls, reconcile receipt of distribution cash, and design team process with Arch’s custom workflows. Assign users to specific tasks and monitor progress with collaborative notes.

Plan your workflow with document arrival estimates.

Arch requests estimates for missing document arrival from investment managers, providing better visibility while managing tax deadlines.

Push data to downstream reporting systems.

Create tech-enabled workflows for reliable delivery of data to downstream systems via API integrations, SFTP dropoffs, flat files, or through our intuitive Open Data Program.

150+ Data Checks ensure organization and accuracy.

Deliver reliable data with proprietary exception processing. Data checks are performed at least twice daily, with critical checks executed in real-time and inconsistencies addressed by a specialized Operations team.

Reclaim your inbox with a single email of investment updates.

Review account updates, upcoming capital calls, and document summaries via Arch’s most popular feature — the Daily Digest. Clients report this one email summarizing portfolio activity can reduce team inbox volume by 80%.

A premium white-glove experience from platform experts.

Onboarding to Arch requires minimal intervention and begins with two simple steps: sharing an investment list and providing authorized signatory information. A dedicated NYC-based Operations team handles the rest. With seamless interested party authorization via DocuSign, an unmatched database of GP and fund administrator protocols, and a track record of successfully onboarding hundreds of thousands of investments, there’s no onboarding too large or too complex for our team.

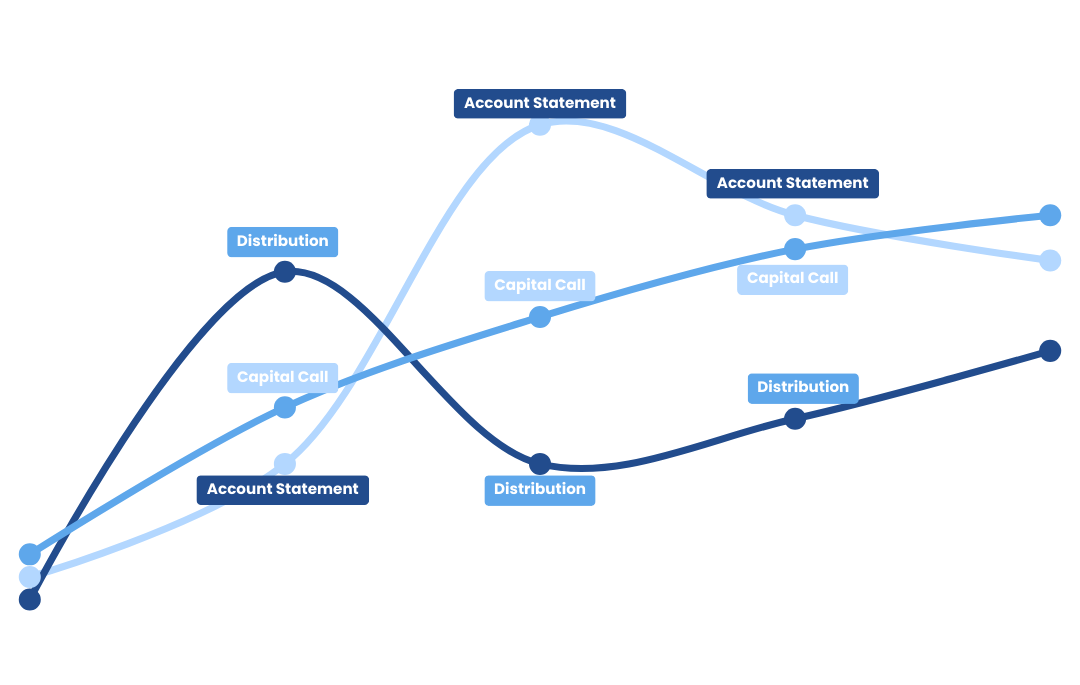

Understand portfolio performance from a synthesized feed of investment activity. Discover, at a glance, how reported NAV compares to the previous quarter, what the impact of a cash flow is on outstanding commitment, or what a capital call is actually funding.

Detail the effects of investment activity across your portfolio.

Aggregate and enrich data with a layer of insights that call out key investment information like quarterly net change in asset value, commitment remaining after a given capital call, or a distribution’s value in relation to original commitment.

Get the key takeaways, without all the noise.

Reclaim time with the Daily Digest and A.I. Summaries that distill lengthy manager updates to the most important information, including specific details regarding Performance Drivers, Acquisitions, Market Outlook, Returns, or Exits.

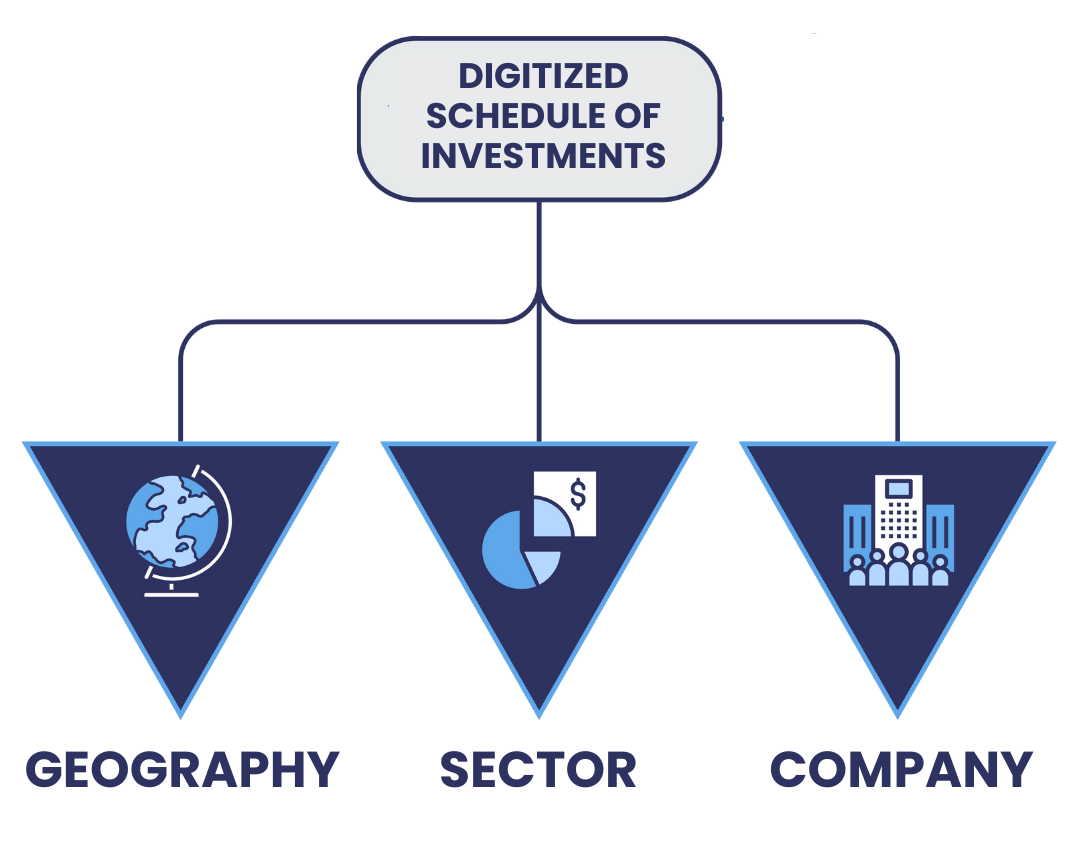

Understand total capital allocation.

Get a better picture of funds' underlying asset exposure with digitized investment schedules and dynamically-calculated financials based on fund ownership, supplemented by in-depth portfolio company insights.

Grant curated access most relevant to differentiated workflows and needs, streamlining all types of investment operations. Empower teams to do their best work with collaboration tools that update in real time across users.

Curated team access.

Elevate cross functional collaboration while protecting sensitive information through intelligent access and visibility controls — from full-team access to specialized views for CPAs and clients.

Communicate across teams within one user-friendly interface.

Enable teams to work smarter by adding notes to different tasks and activities, securely storing documents for clients, and viewing download history on tax documents.

Deliver data to other software in your tech stack.

Arch believes that you should be able to use your data for whatever purpose is most beneficial. Our Open Data Program boasts robust API integrations with tools like Addepar, Salesforce, and Bipsync, as well as additional export templates optimized for delivery to other systems – all to allow for greater connectivity.

Connectivity With

Our thesis at Arch is that by aggregating all of your data into one place, then layering on actionable insights and meaningful collaboration tools, you can save time and resources – unlocking better and faster decision-making for all different types of roles across the private investment space.

Individual Investors

Investing in alternatives as an individual means time spent logging into portals, tracking down documents, and organizing an overflowing email inbox. Arch acts as a single source of truth, handling administration of investment data with one user-friendly portal and updates from all managers consolidated in a daily email. With Arch, individual investors can reclaim time, energy, and effort.

Wealth Manager

Keeping track of clients' diverse alternative investments can be time-consuming and error-prone, especially when information is scattered across various platforms. Arch not only offers advisors a comprehensive view of clients' portfolios, but also consolidates tech solutions — reducing reporting timelines by up to 90%.

Family Offices

Overseeing multi-generational wealth requires stakeholders to collaborate across various teams, without compromising privacy. Whether managing the wealth of a single family or many, Arch provides managers with unique user access, only delivering the updates most relevant to specific team members via curated portal permissions and Daily Digest notifications.

Institutional Allocator

Institutional clients depend upon timely and accurate updates related to alternative investments, but aggregation of data for allocators and their teams is inefficient and costly, with with data spread across multiple GPs and other providers. Arch’s emphasis on timely reporting and data quality empowers allocating teams to focus on maximizing returns for their clients.

CPA & Tax Specialist

Preparing tax returns for clients with alternative investments is a historically painful process, fraught with extended reporting timelines and inconsistent access across disparate systems. Arch provides a seamless tax experience, aggregating all necessary documents into one user-friendly portal, while proactively reaching out to fund managers when documents are missing. With Arch, tax preparers simply log in and download documents for filing.

Investment Team & CIO

Analyzing alternative investments requires countless hours sifting through extensive data and documents to understand performance, opportunities, and risks. Arch’s automation tools like LPA extraction, A.I. Summaries, and portfolio company Lookthroughs provide investment teams with key facts and details in a standardized format that allows managers to refocus on strategic analysis.

Fund Manager

Sharing portfolio information with investors is hamstrung by legacy portals with outdated infrastructure. Arch streamlines the Limited Partner experience through consolidated communication, exportable data, and, most importantly, one login.

Reporting Analyst

Junior employees bear the burden of hundreds of hours spent managing logins to manually aggregate, parse, and store investment documents for relevant data. Arch’s proprietary data collection and extraction tools allow for analysts to scale back administrative tasks and hone in on higher impact work.